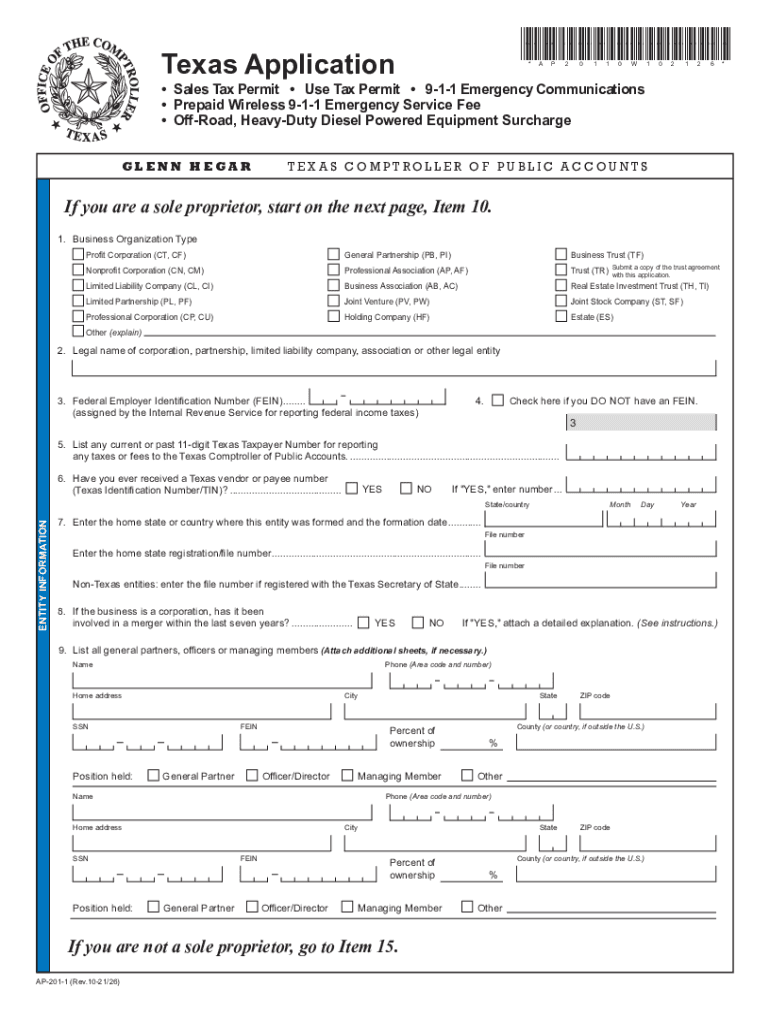

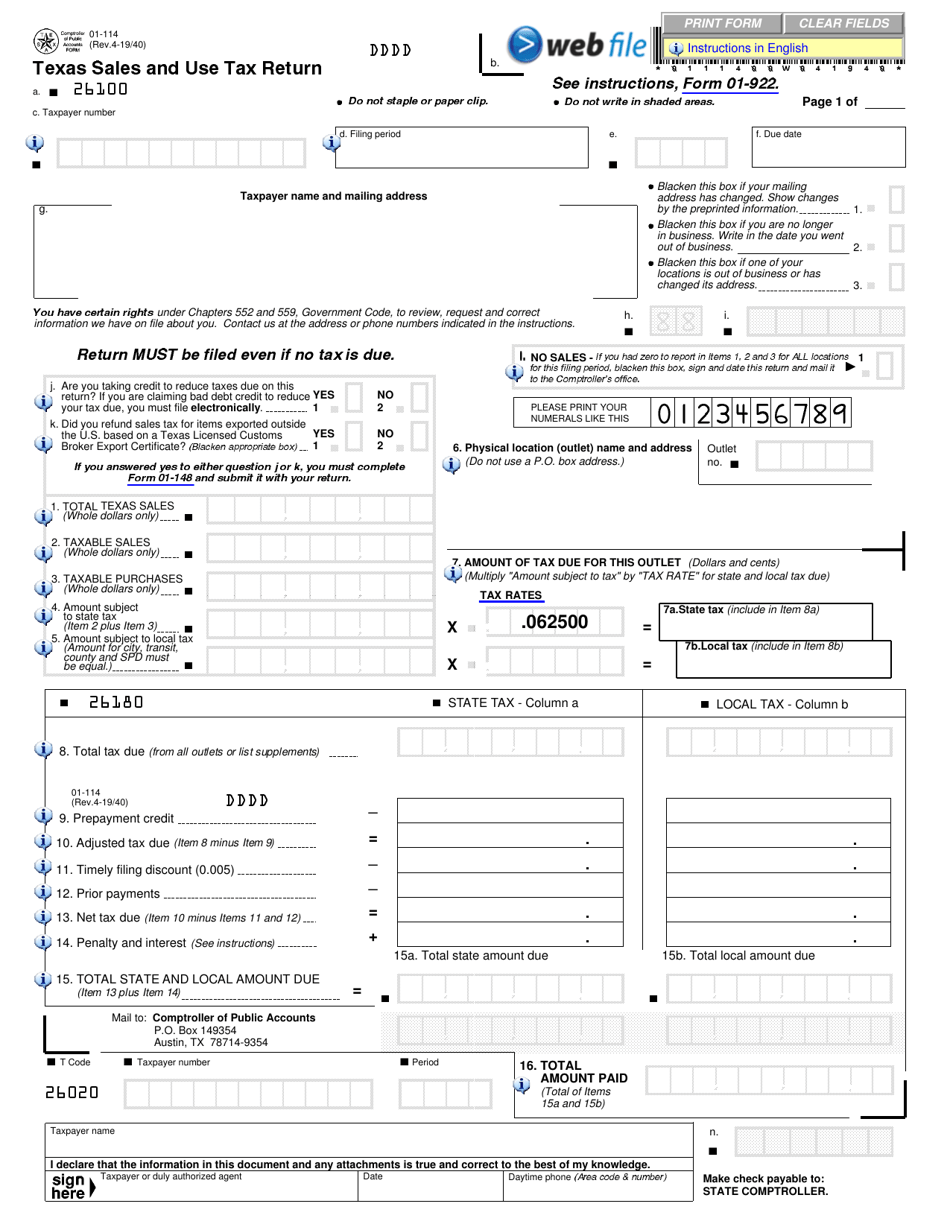

Sales Tax In Texas 2025 - Form 01114 Download Fillable PDF or Fill Online Texas Sales and Use, April 2025 sales tax due dates. Moneygeek’s system of grading states on tax burden only holds true for that hypothetical family. In 2025, the texas sales tax holidays will be held on the following dates:

Form 01114 Download Fillable PDF or Fill Online Texas Sales and Use, April 2025 sales tax due dates. Moneygeek’s system of grading states on tax burden only holds true for that hypothetical family.

Sales Tax By State Map Printable Map, The texas comptroller of public accounts aug. (austin) —texas comptroller glenn hegar today said state sales tax revenue totaled $4.06 billion in december, 3.2 percent more than in december 2025.

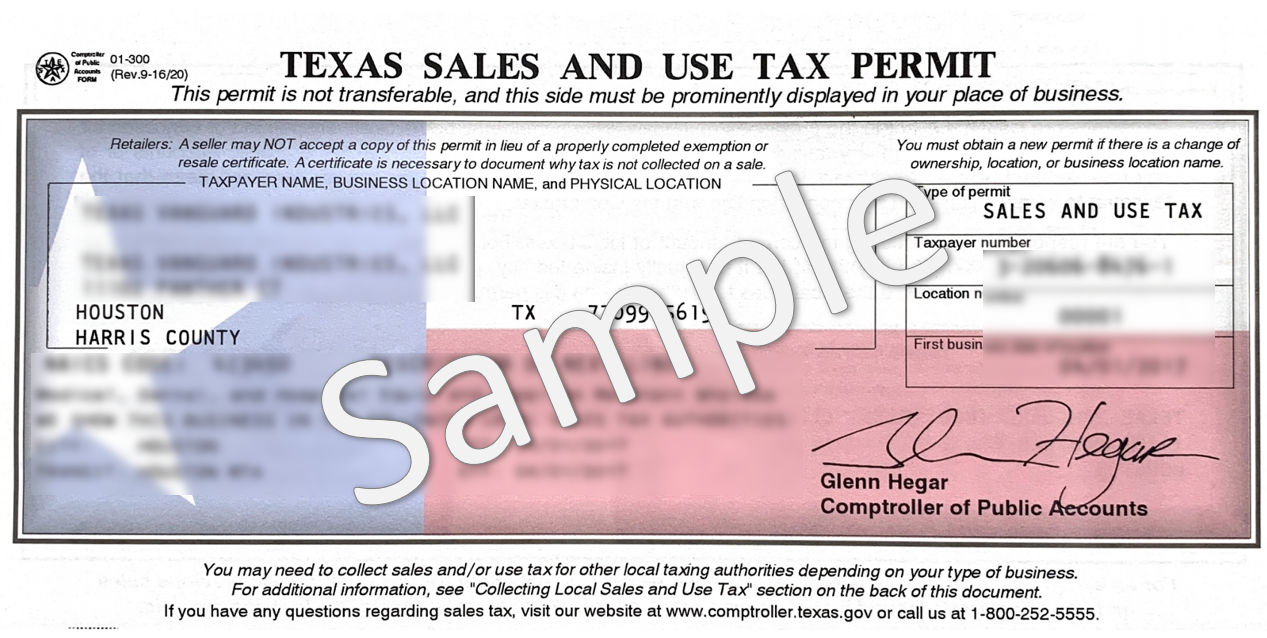

Texas Sales Tax Permit 20252025 Form Fill Out and Sign Printable PDF, These rates include local and. Economic nexus treatment by state, 2025.

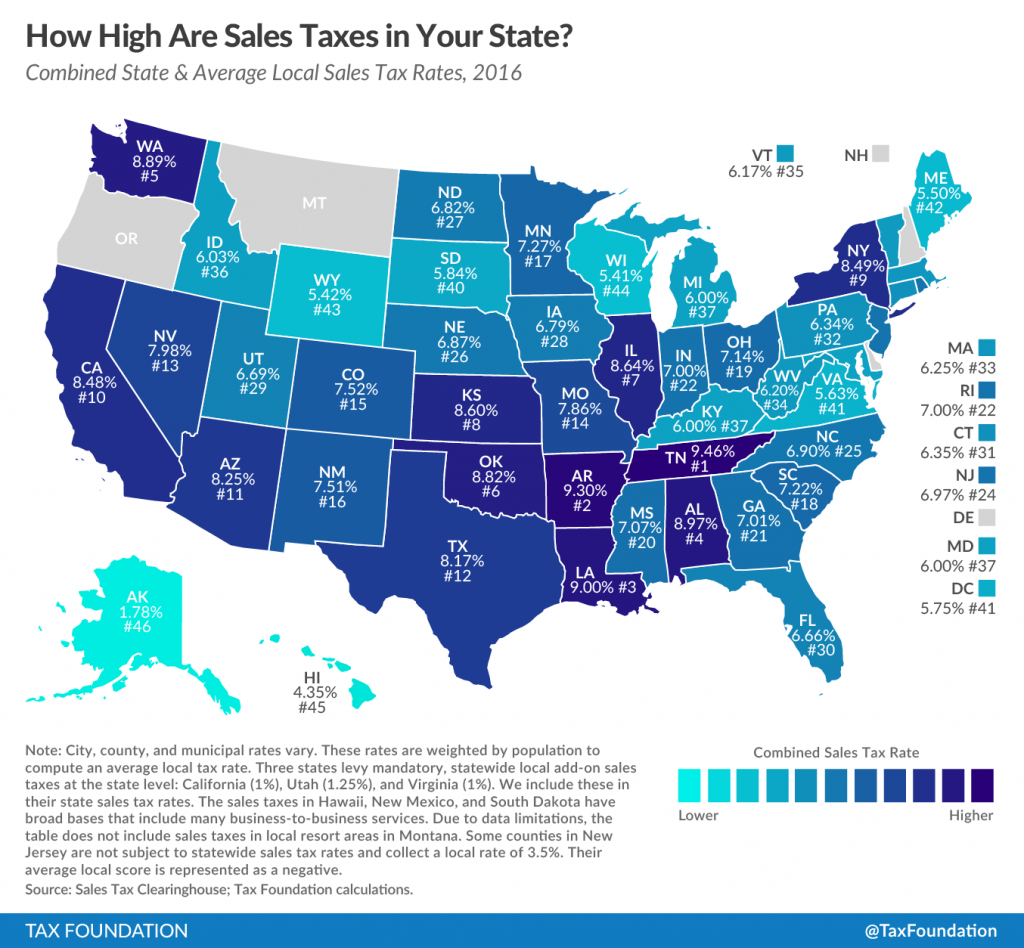

Top 3 which states do not collect sales tax in 2025 Gấu Đây, Texas has state sales tax of 6.25% , and allows local governments to collect a local option sales. 2025 texas sales tax table.

Texas “Sales & Use Tax Permit” y el “Resale Certificate” Todo lo que, These rates include local and. Tax rates are provided by avalara and updated monthly.

How Much Does Your State Collect in Sales Taxes Per Capita? Fortyfive, The texas state sales tax rate is 6.25%, and the average tx sales tax after local surtaxes is 8.05%. Those costs are passed on to the buyer,.

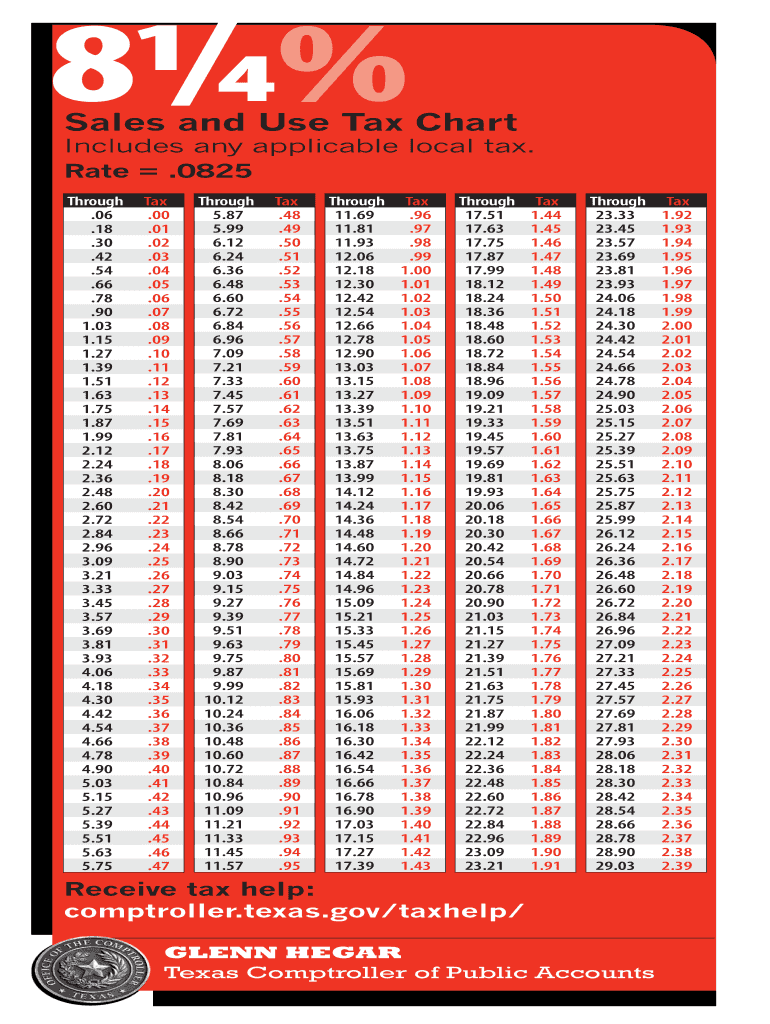

8 25 tax chart texas Fill out & sign online DocHub, Divide across texas 2025 report to the people 7 sessions summary: Average sales tax (with local):

taxes scolaires granby, These rates include local and. 2025 texas sales tax calculator.

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue, Sales and use tax rate charts. Texas emergency preparation supplies sales tax.

Every 2025 combined rates mentioned above are the results of texas state rate (6.25%), the houston tax rate (0% to 1.75%), and in some case, special rate (0.25% to 2%).

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Sales tax is a percentage (ranging from 2.9% to 7.25% in texas) added to the price of a taxable product or service.